How Changing Two Colors Increased Conversion Rates by 257% and Generated $1.2 Million in ARR

Analyzing the Data

After reviewing our most recent KPI performance, we identified a disconnect between our messaging and the target audience. Impressions weren’t the issue—in fact, we saw a notable increase, particularly after investing in partnership and affiliate programs. However, key performance indicators such as actions, installs, registrations, and accounts opened remained stagnant.

Our analysis revealed that the customer journey was breaking down at the very top of the funnel, with significant drop-offs continuing through to the bottom. It became clear that to improve results, we needed to rethink our approach to engagement and streamline the user experience.

Affiliate Program 2023 Year

Newsletter 2023 Year

Strategic Changes to Messaging and User Engagement

To address the drop in conversions, we made a few key adjustments to our messaging strategy. One major insight came from testing the way we communicated our offering. Instead of simply promoting it as “free,” we included an actual dollar value. This change in perceived value had a noticeable impact, helping increase conversions from registration to account opening.

Drip Email Campaigns

We also identified a significant drop-off immediately following the registration phase. To re-engage these users, we launched a targeted drip email campaign aimed at stale applicants. The campaign included educational content on credit, highlights of new subscription-based products, and reminders that one final step remained to complete the onboarding process.

While the campaign led to a modest improvement in engagement, it still didn’t generate the level of response we were aiming for—signaling the need for a more comprehensive approach to improving the entire customer journey.

Refining the Target Audience

In an effort to better understand our customer base, we conducted a deep dive into broader data pools, analyzing key demographics such as age, financial status, marital status, geographic location, and career type. What we discovered was a game-changer: the majority of our active users were not the young college students we had originally targeted. Instead, our core audience consisted primarily of older millennials with more established financial needs.

This insight prompted a complete shift in our marketing strategy.

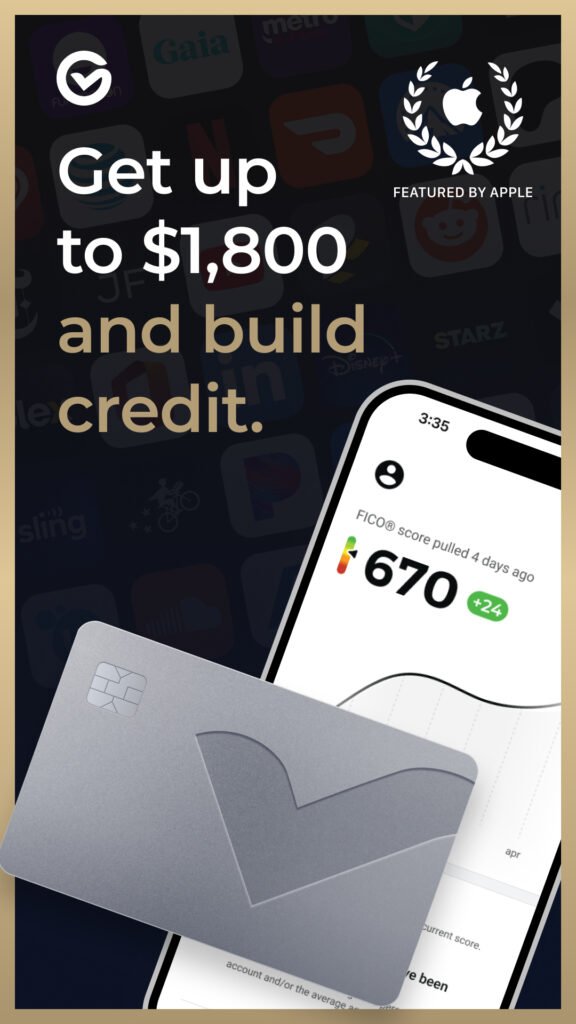

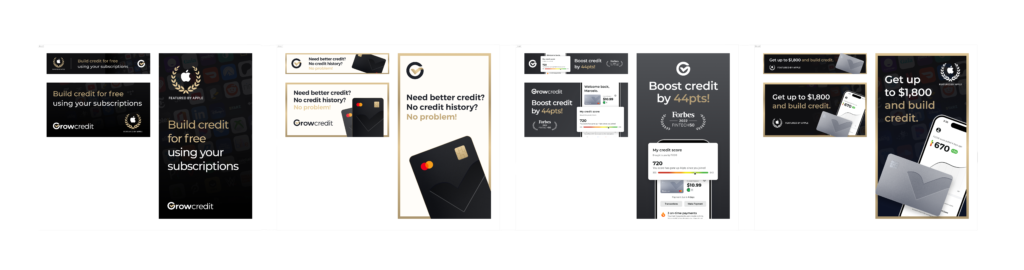

We rebranded the visual identity of Grow Credit, moving away from the youthful purple, white, and blue color scheme to a more mature, premium palette of black, white, and gold. In addition to updating the logo and branding, we redesigned the look of our virtual Mastercards and refined the messaging and visuals used across all advertising touchpoints to better align with this new target demographic.

Outcome

We launched our refreshed brand through a strategic partnership, collaborating with a partner we had previously tested campaigns with. The results were striking.

This single campaign generated $1.2 million in annual recurring revenue (ARR) and led to a 257% increase in registration-to-account-open conversion rates. In addition, newsletter conversions saw a major lift. Similar performance improvements were observed with other partners as they began integrating the new visual assets into their paywalls and promotional materials.

This transformation not only validated the power of audience alignment and visual branding—but also reinforced the importance of ongoing data analysis and adaptation in performance marketing.

1 Month After Audience and Visual Realignment

Newsletter 2024 Year After Audience and Visual Realignment

Partnership Campaign Totals